By Fraser Perkins —

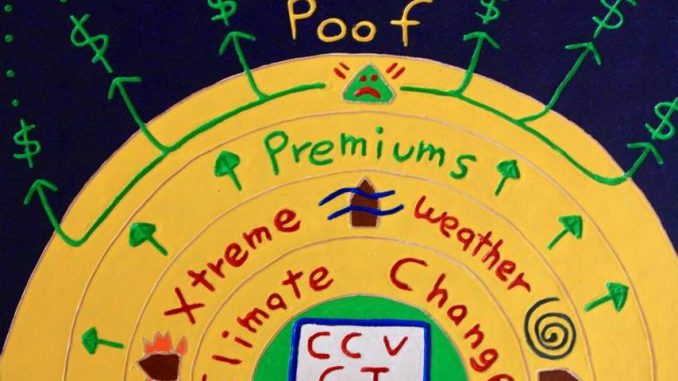

The secondary effects of Climate Change have taken center stage in Florida and Texas – home insurance rates have skyrocketed. In Florida, insurer AIG stopped issuing new policies for coastal residents, while Farmers went even further and stopped writing any new homeowner policies. Factors cited for curtailment of policies include soaring replacement costs and rampant fraudulent claims, but the heart of the problem is Climate Change. Florida experiences 40% of the hurricanes in the US and as water temperatures rise, Florida will see more major hurricanes and suffer greater losses. Floridians pay an average of $6,000 per year for home insurance versus a national average of $1,700. This is projected to spiral up to $8,400 in the coming year. As private insurers exit Florida, the state-chartered Citizens Property Insurance Corporation has become the default insurer for an increasing number of homeowners. Citizens currently insures 15% of Floridians, but as this percentage grows, it will be exposed to a greater risk of catastrophic losses. In the event its reserves are exhausted by a major hurricane, the other Florida insurers, as well as the state and Floridians in general, will be called on to make up for losses.

Texas mirrors the Florida dilemma. Insurers have noted the increased risk from extreme weather events and have raised rates. Nationally, rates have increased by 21% since 2015; in Texas rates have gone up by 40%. This will have far ranging effects. Mortgage lenders require lenders to acquire fire insurance, but not flood insurance. To save money, some homeowners may opt to forego flood insurance in flood prone coastal areas.

In both states, would-be home developers and buyers are moving into high risk areas – low elevation coastal areas – a setup for future losses. The entire Gulf Coast is at risk from a “perfect storm” of subsidence, high tides, torrential downpours, and storm surge during a major hurricane. Extreme weather in the Southeast will be felt in Connecticut, home of the insurance industry.

One might think that politicians – such as US Senators – would support climate adaptation and mitigation, but you would be wrong. Not a single US Senator from Texas, Louisiana, Mississippi, Alabama, and Florida voted for the Inflation Reduction Act which contained major climate proposals.

Leave a Reply